Engulfing Pattern

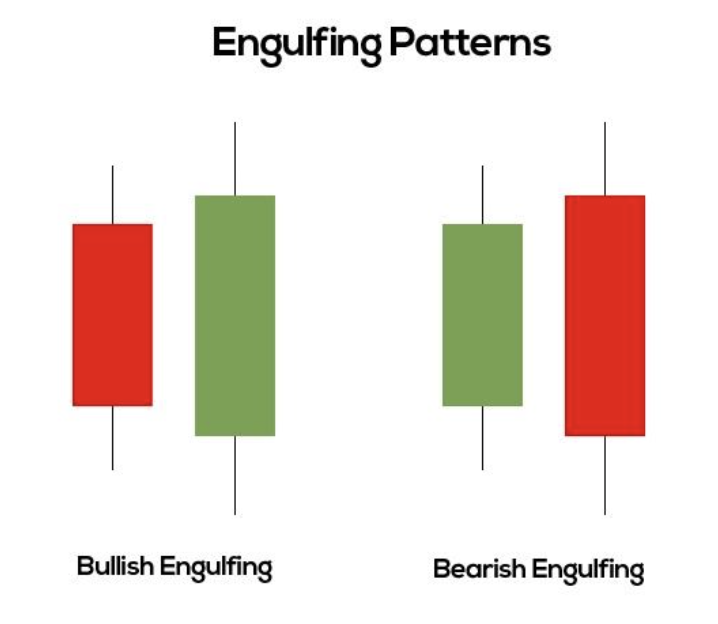

The engulfing candlestick pattern is a significant technical analysis signal that often indicates a potential reversal in the prevailing market trend. This pattern is formed by two consecutive candlesticks, where the body of the second candle completely engulfs the body of the preceding one. There are two types of engulfing patterns: bullish engulfing and bearish engulfing.

- Bullish Engulfing Pattern:

- Formation: The first candle in this pattern is typically a smaller bearish (downward) candle, followed by a larger bullish (upward) candle whose body completely engulfs the previous bearish candle.

- Implication: The bullish engulfing pattern suggests a potential reversal from a downtrend to an uptrend. It indicates that buyers have overwhelmed sellers, leading to increased buying interest.

- Bearish Engulfing Pattern:

- Formation: In contrast, the bearish engulfing pattern begins with a smaller bullish (upward) candle, followed by a larger bearish (downward) candle that completely engulfs the prior bullish candle.

- Implication: The bearish engulfing pattern signals a potential reversal from an uptrend to a downtrend. It suggests that sellers have gained control, overpowering the buyers and indicating a shift in market sentiment.

Get started with the engulfing

Simply make an HTTPS [GET] request or call in your browser:

[GET] https://api.taapi.io/engulfing?secret=MY_SECRET&exchange=binance&symbol=BTC/USDT&interval=1h

API response

The engulfing endpoint returns a JSON response like this:

{

value: "100" // engulfing pattern found at this candle

}

// OR

{

value: "-100" // engulfing bearish variation (if applicable) found at this candle (not all patterns have bearish variations)

}

// OR

{

value: "0" // engulfing pattern NOT found at this candle

}

Example responses from TAAPI.IO when querying engulfing endpoint.

API parameters

binance,

binancefutures or one of our supported exchanges. For other crypto / stock

exchanges, please refer to our Client

or Manual integration methods.

BTC/USDT Bitcoin to Tether, or

LTC/BTC Litecoin to Bitcoin...

1m,

5m, 15m, 30m, 1h, 2h,

4h, 12h, 1d, 1w. So if you're

interested in values on hourly candles, use interval=1h, for daily values

use interval=1d, etc.

backtrack parameter removes candles from the data set and calculates

the engulfing value X amount of candles back. So, if you are fetching the

engulfing on the hourly and you want to know what the

engulfing was 5 hours ago, set backtrack=5. The default is

0.

chart parameter accepts one of two values: candles or

heikinashi. candles is the default, but if you set this to

heikinashi, the indicator values will be calculated using Heikin Ashi

candles. Note: Pro & Expert Plans only.

true or false. Defaults to false. By setting to

true the API will return a timestamp with every result (real-time and

backtracked) to which candle the value corresponds. This is especially helpful when

requesting a series of historical values using the results parameter.

1685577600

1731456000 If

you only use fromTimestamp, the API will return all results from that time until

present.

number or max. Use this parameter to access historical

values on the past X candles until the most recent candle. Use max

to return all available historical values. Returns an array with the oldest value on top

and most recent value returned the last.

More examples

Let's say you want to know the engulfing value on the last closed

candle on the 30m timeframe. You are not interest in the real-time value, so you

use the backtrack=1 optional parameter to go back 1 candle in history to the last

closed candle.

[GET] https://api.taapi.io/engulfing?secret=MY_SECRET&exchange=binance&symbol=BTC/USDT&interval=30m&backtrack=1

Get engulfing values on each of the past X candles in one call

Let's say you want to know what the engulfing daily value was each

day for the previous 10 days. You can get this returned by our API easily and efficiently in one

call using the results=10 parameter:

[GET] https://api.taapi.io/engulfing?secret=MY_SECRET&exchange=binance&symbol=BTC/USDT&interval=1d&results=10

Here's the example response:

{

"value": [

0,

0,

0,

100, // <-- Pattern found at this candle

0,

0,

-100, // <-- Bearish variation pattern found at this candle

0,

0,

0 // <-- Most recent value

]

}