Volume Split

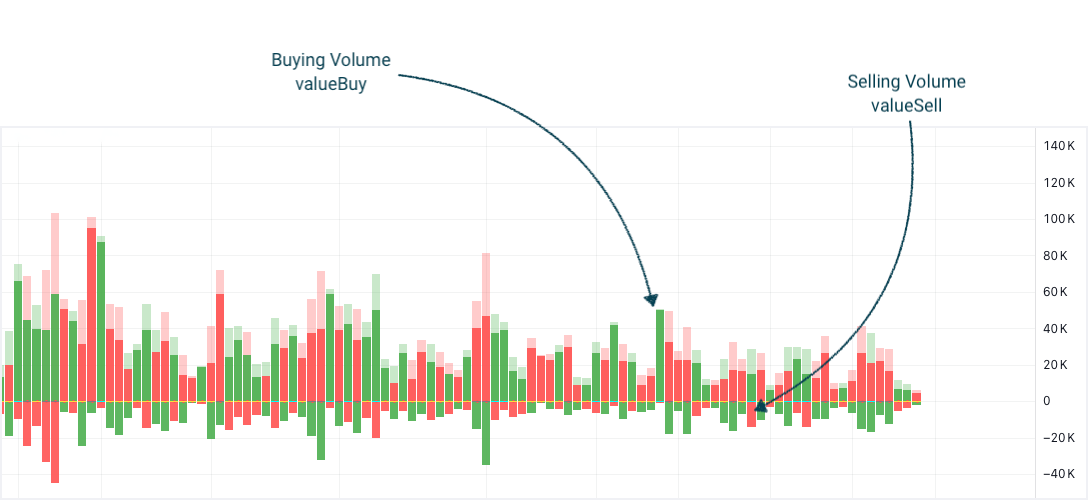

The Volume Split indicator helps traders analyze the buying and selling pressure in the market. By breaking down the total traded volume into buying and selling components, this indicator provides a deeper insight into market dynamics.

The Volume Split indicator determines buying and selling volumes by analyzing the price movement within each bar. Buying volume is calculated based on how much the price has moved up from the lowest point to the closing price. If the price closes higher in a bar, the volume associated with that upward movement is considered buying volume. Conversely, selling volume is calculated based on how much the price has moved down from the highest point to the closing price. If the price closes lower in a bar, the volume associated with that downward movement is considered selling volume. When the high and low prices are the same, both buying and selling volumes are set to zero to avoid errors.

How to understand Volume Split API Responses

When you use our API to get the Buying Selling Volume data, you receive a JSON object with the following values:

valueTotalThis is the total volume of trades within the specified period. It represents the sum of all buying and selling activities.valueBuyThis is the volume attributed to buying activities. It shows the portion of the total volume where traders are purchasing the asset.valueSellThis is the volume attributed to selling activities. It shows the portion of the total volume where traders are selling the asset.percentBuyThis is the percentage of the total volume that is attributed to buying activities. It indicates how much of the trading volume was due to purchases.percentSellThis is the percentage of the total volume that is attributed to selling activities. It indicates how much of the trading volume was due to sales.

Credit

This indicator was inspired by and derived from an implementation by Ceyhun.

Get started with the volumesplit

Simply make an HTTPS [GET] request or call in your browser:

[GET] https://api.taapi.io/volumesplit?secret=MY_SECRET&exchange=binance&symbol=BTC/USDT&interval=1h

API response

The volumesplit endpoint returns a JSON response like this:

{

"valueTotal": 6375.229269996414,

"valueBuy": 1190.3238075620077,

"valueSell": 5184.905462434405,

"percentBuy": 18.67107451592368,

"percentSell": 81.32892548407631

}

Example response from TAAPI.IO when querying volumesplit endpoint.

API parameters

binance,

binancefutures or one of our supported exchanges. For other crypto / stock

exchanges, please refer to our Client

or Manual integration methods.

BTC/USDT Bitcoin to Tether, or

LTC/BTC Litecoin to Bitcoin...

1m,

5m, 15m, 30m, 1h, 2h,

4h, 12h, 1d, 1w. So if you're

interested in values on hourly candles, use interval=1h, for daily values

use interval=1d, etc.

backtrack parameter removes candles from the data set and calculates

the volumesplit value X amount of candles back. So, if you are fetching the

volumesplit on the hourly and you want to know what the

volumesplit was 5 hours ago, set backtrack=5. The default is

0.

chart parameter accepts one of two values: candles or

heikinashi. candles is the default, but if you set this to

heikinashi, the indicator values will be calculated using Heikin Ashi

candles. Note: Pro & Expert Plans only.

true or false. Defaults to false. By setting to

true the API will return a timestamp with every result (real-time and

backtracked) to which candle the value corresponds. This is especially helpful when

requesting a series of historical values using the results parameter.

1685577600

1731456000 If

you only use fromTimestamp, the API will return all results from that time until

present.

number or max. Use this parameter to access historical

values on the past X candles until the most recent candle. Use max

to return all available historical values. Returns an array with the oldest value on top

and most recent value returned the last.

More examples

Let's say you want to know the volumesplit value on the last closed

candle on the 30m timeframe. You are not interest in the real-time value, so you

use the backtrack=1 optional parameter to go back 1 candle in history to the last

closed candle.

[GET] https://api.taapi.io/volumesplit?secret=MY_SECRET&exchange=binance&symbol=BTC/USDT&interval=30m&backtrack=1

Get volumesplit values on each of the past X candles in one call

Let's say you want to know what the volumesplit daily value was each

day for the previous 10 days. You can get this returned by our API easily and efficiently in one

call using the results=10 parameter:

[GET] https://api.taapi.io/volumesplit?secret=MY_SECRET&exchange=binance&symbol=BTC/USDT&interval=1d&results=10

Looking for even more integration examples in different languages like NodeJS, PHP, Python, Curl or Ruby? Continue to [GET] REST - Direct documentation.