Chande Momentum Oscillator

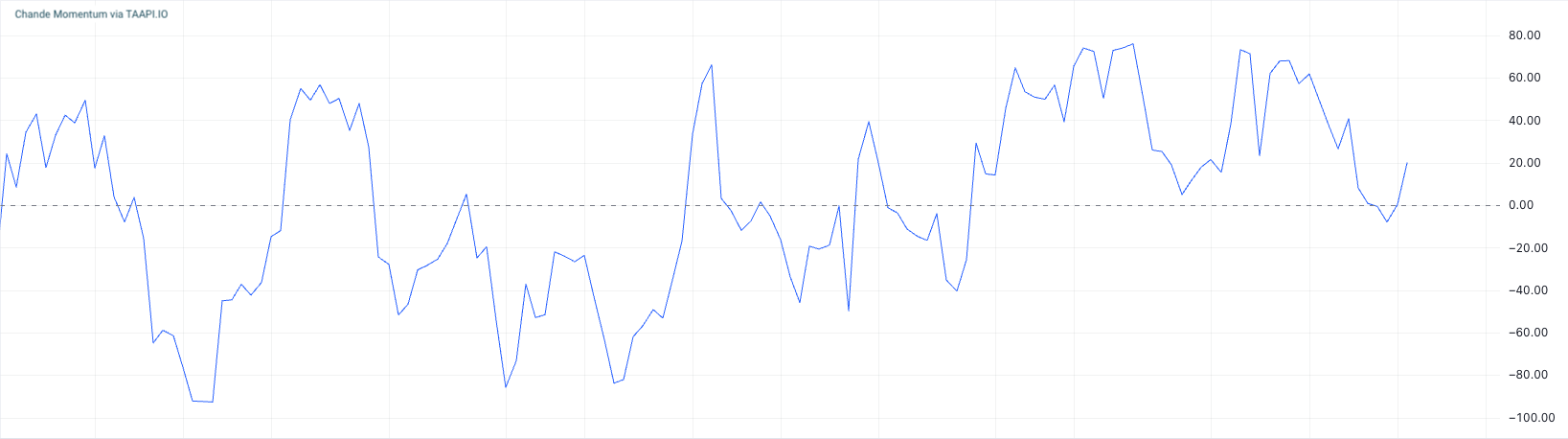

The Chande Momentum Oscillator (CMO) is a technical analysis tool used to measure the momentum of price movements in a financial market. It was developed by Donald Dorsey and is designed to identify overbought and oversold conditions in an asset’s price.

Similarly to the popular RSI, CMO is also also used to spot overbought and oversold conditions, as well as to gauge the strength of a trend.

How to use CMO

1. Overbought and Oversold Conditions:

- CMO value above

+50is considered overbought, suggesting that the asset might be overvalued and due for a price correction. - CMO value below

-50is considered oversold, indicating that the asset might be undervalued and due for a price increase.

2. Centerline Crossover:

- When the CMO crosses above the

0line, it indicates a potential buying opportunity. - When the CMO crosses below the

0line, it signals a potential selling opportunity.

3. Trend Confirmation:

- A rising CMO indicates strengthening momentum, suggesting a continuation of the current trend.

- A falling CMO indicates weakening momentum, suggesting a potential reversal or consolidation.

Get realtime and historical values via API

We provide API access to the Chande Momentum Oscillator values for all of the most popular assets like stocks, crypto (try one of the popular exchanges like Binance) and forex, on all commonly used timeframes – from the weekly and daily all the way down to one minute intervals. You can also calculate the values on your own data using our manual method.

Customise CMO Sensitivity

When using the CMO technical indicator, you have the ability to fine-tune its responsiveness by adjusting the optional period parameter through the API. This parameter allows you to customize the number of candles considered in the CMO calculation. If you opt for a shorter period, the CMO becomes more sensitive, responding quickly to recent price changes and potentially signaling overbought or oversold conditions sooner. On the other hand, choosing a longer period smoothens the CMO’s output, offering a broader perspective on market trends. This feature lets you tailor the CMO to fit your specific trading strategies and timeframes, enhancing its effectiveness in various market conditions.

Get started with the cmo

Simply make an HTTPS [GET] request or call in your browser:

[GET] https://api.taapi.io/cmo?secret=MY_SECRET&exchange=binance&symbol=BTC/USDT&interval=1h

API response

The cmo endpoint returns a JSON response like this:

{

"value": 48.115851780097856

}

Example response from TAAPI.IO when querying cmo endpoint.

API parameters

binance,

binancefutures or one of our supported exchanges. For other crypto / stock

exchanges, please refer to our Client

or Manual integration methods.

BTC/USDT Bitcoin to Tether, or

LTC/BTC Litecoin to Bitcoin...

1m,

5m, 15m, 30m, 1h, 2h,

4h, 12h, 1d, 1w. So if you're

interested in values on hourly candles, use interval=1h, for daily values

use interval=1d, etc.

backtrack parameter removes candles from the data set and calculates

the cmo value X amount of candles back. So, if you are fetching the

cmo on the hourly and you want to know what the

cmo was 5 hours ago, set backtrack=5. The default is

0.

chart parameter accepts one of two values: candles or

heikinashi. candles is the default, but if you set this to

heikinashi, the indicator values will be calculated using Heikin Ashi

candles. Note: Pro & Expert Plans only.

true or false. Defaults to false. By setting to

true the API will return a timestamp with every result (real-time and

backtracked) to which candle the value corresponds. This is especially helpful when

requesting a series of historical values using the results parameter.

1685577600

1731456000 If

you only use fromTimestamp, the API will return all results from that time until

present.

number or max. Use this parameter to access historical

values on the past X candles until the most recent candle. Use max

to return all available historical values. Returns an array with the oldest value on top

and most recent value returned the last.

Sets the number of candles used in the indicator calculation.

Default: 14

More examples

Let's say you want to know the cmo value on the last closed

candle on the 30m timeframe. You are not interest in the real-time value, so you

use the backtrack=1 optional parameter to go back 1 candle in history to the last

closed candle.

[GET] https://api.taapi.io/cmo?secret=MY_SECRET&exchange=binance&symbol=BTC/USDT&interval=30m&backtrack=1

Get cmo values on each of the past X candles in one call

Let's say you want to know what the cmo daily value was each

day for the previous 10 days. You can get this returned by our API easily and efficiently in one

call using the results=10 parameter:

[GET] https://api.taapi.io/cmo?secret=MY_SECRET&exchange=binance&symbol=BTC/USDT&interval=1d&results=10

Looking for even more integration examples in different languages like NodeJS, PHP, Python, Curl or Ruby? Continue to [GET] REST - Direct documentation.